【摘要】在航运实务中,港口当局会收取各种各样的费用,那么这些费用是否可归属于港口费用?如果是针对船员方面的检疫费用是否船东得另行承担?本文通过实务中常见的问题来说一说港口费用方面的问题。

【关键词】检验检疫、港口费用、证书、Port charge

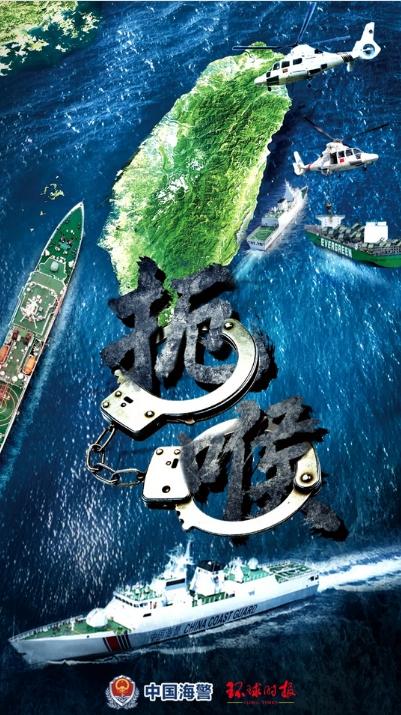

2018年1月19日,国家质量监督检验检疫总局关于防止黄热病传入我国发布了2018年的第11号公告,其内容如下:

据世界卫生组织报告,2017年7月2日至12月19日尼日利亚通报341例黄热病疑似病例,死亡45例;2017年1月1日至12月13日秘鲁通报17例黄热病病例,死亡3例;据巴西卫生部通报,2017年7月1日至2018年1月14日巴西共发现470例黄热病疑似病例,确诊35例,死亡20例。

为防止黄热病传入我国,保护我国前往上述国家人员的健康安全,根据《中华人民共和国国境卫生检疫法》及其实施细则的有关规定,现公告如下:

一、来自尼日利亚、秘鲁、巴西(除塞阿拉州、北里奥格德州、帕拉伊巴州、伯南布哥州、阿拉戈斯州、塞尔希培州外)满9个月龄以上的人员,入境时应当向出入境检验检疫机构出示有效的黄热病预防接种证书。对无有效黄热病预防接种证书的人员,必须从离开该国时计算,实施6日的居住地观察。

二、来自上述国家和地区的人员,如有发热、寒战、头痛、肌痛等症状,入境时应当主动向出入境检验检疫机构申报,并配合其开展体温监测、医学巡查、采样检测等卫生检疫工作。如在入境后出现上述症状,应当立即就医,并向医生说明近期的旅行史,以便及时得到诊疗。

三、来自上述国家和地区的航空器、船舶和集装箱应当经过有效的除虫处理;对来自上述国家的集装箱、废旧物品和发现有病媒昆虫的货物,以及无有效灭蚊证明的航空器、船舶,需实施除虫处理。没有完成除虫处理之前,船舶与陆地和其他船舶的距离不能少于400米。

四、口岸运营单位应采取有效措施,清除蚊虫孳生地,监测和控制口岸蚊虫密度。出入境检验检疫机构应当加强口岸卫生监督和蚊虫监测工作。

五、前往上述国家和地区的人员可以向各地出入境检验检疫机构及其国际旅行卫生保健中心咨询有关情况,或登陆质检总局网站(http://www.aqsiq.gov.cn)卫生检疫专栏查询相关信息。前往黄热病流行区需要提前10 天到国际旅行卫生保健中心接种黄热病疫苗;旅行时注意避免被蚊虫叮咬,一旦发现上述症状,需要立即就医。

六、黄热病是蚊媒传播疾病,潜伏期3-6天,症状主要为发热、头痛、肌痛、恶心呕吐等,重症患者可出现黄疸、蛋白尿、肾衰、休克等症状。

本公告自发布之日起生效,有效期3个月。

近期有船H轮到辽宁某一著名的港口卸货,按照质检总局的第三条的要求,该港口的卫检当局,如去年的大头蚊子一样,要求对抵港船舶经行检验检疫,并需提供黄热证书。相关的费用,透过代理如下电邮可知,卫生证书1,500美金;但需要额外的拖轮费约68,000人民币。如果春节期间就不得而知,但肯定至少需要100%的加班费。

Further on our below message,and after checked quarantine officers, please be kindly advised that if subject vessel do not have "Mosquito Eradication Certification"on board, the anchorage quarantine inspection will be conducted, and quarantine officer will issue "Sanitation report" for subject vessel after inspection, and relevantcost asf,

Item amount

Cost for "Sanitation report" usd1500.00,whichdepends on subject vessel's sanitation condition, will settled against o.voucher

Tugboat hire fee rmb1.5/hp/hr *6500hp * hrs calculate onactually working time ( working time is about 6-7hrs)

Please confirm for above expenses for us to further check with quarantine officer about the schedule ofquarantine inspection.

M/w, we are still consulting with quarantine officer whether it is possible to arrange berthing quarantine inspection, and further progress will keep you posted closely onceavailable.

经过沟通协商之后,透过代理的电邮可知,当局同意不需要到锚地检验检疫,收取15,000人民币的特别奖金,约2,500美金,不提供发票。当然还有卫生证书的费用,1,500美金,此部分可提供发票。

Further on our exchange,please be kindly advised after our manager's consulting with quarantine officer, they finally agreed to conduct quarantine inspection and disinfectionfor subject vessel after her berthing by paying special bonus rmb15000.00(usd2500.00) with out voucher.

So additional costscaused by yellow fever epidemic are asf,

Item Amount

Cost for "Sanitation report" usd1500.00,which depends on subjectvessel's sanitation condition, will settled against o.voucher

Special bonus usd2500.00/rmb15000.00

And after contacted with our principal, be informed such additional cost will be in owner's account.

So please confirm for above additional cost and advise your payment for our further arrangement.

Fyi, according to our financial department's regulation, such additional expenses should be collectedb 4 subject vessel's departure.

但是代理接着说此部分额外的费用属于船东费用,要求船东确认并需在离港前支付。那么问题来了,这类因为临时政策规定,而额外增加的费用是否需要船东独自承担?还是可归属于港口使费?

把该问题转向程租的租家,要求其指示代理将此部分费用计入港口使费,一并结算。该H轮的租家洋洋洒洒很专业地回复了一大篇,其中部分内容如下。

It has been long established that the seaworthiness obligation covers not only the physical condition of the vessel and its equipment, but it also extents to the competence of the crew, and the adequacy of stores and the possession of necessary documents. In a case called the “Madeleine” (1967), concerning the absence of a certificates, it was established that the vessel is not seaworthy if the documentation required for the voyage is inadequate.

For this reason, the obligation to provide a seaworthy ship attaches at the time of sailing on our COA. If the vessel is bound to China it has to comply with the port entry formalities laid down by the Chinese authorities at their own cost and time. Compliance with such requirements is related to the fulfillment of the seaworthiness obligation in the contract.

Therefore, in case Owners decide to sail to China without compulsory certificates on board, vsl might suffer delay at discharging port on Owner’saccount.

大意是该租家认为,长久以来,适航义务不仅涵盖了船舶及其设备的实际状况,而且还涵盖了船员的能力,物料的充足性和拥有必须的文件。声称在The “Madeleine”案中,由于没有证书,确定如果航行所需文件不足,则该船舶不适航。认为COA合同中,提供适航船舶的义务是附加的。如果船舶将前往中国,她必须遵守中国当局的港口入境手续,自行承担时间和费用。遵守这些要求与履行合同中的适航义务有关。因此,声称如果船东决定在没有船上强制性证书的情况下前往到中国,船舶可能在卸港招致延误,船东得独自承担。

针对租家此电邮,作了如下答复:

Well noted charterers' last with many thanks, but regret to say that Owners are unable to accept charterers' allegation.

As charterers contended that "Madeleine" case, absence of a certificates cause vessel's unseaworthiness.

In "Madeleine" case, owners wish to point out this was time chartered on Baltime form, andprovision which provide: ''in every way fitted for ordinary cargo service". The vessel lack of deratisation certificate prevented a good delivery being made at Calcutta, without thatdocument, the ship could not sail to a port outside India. Roskill, J., held that the phrase “in everyway fitted for ordinary cargo service” was an express undertaking of seaworthiness and that seaworthiness required that the ship possess the documents necessary to enable it to sail.

But for H case, there is not any requirement at load port to obtain this mosquito eradication control certificate, the vessel is free to sail from load port and safely reach herdischarge port.

Since the yellow fever mosquito control effects from 19/Jan/2018, the charterers are well aware that the vessel sailed away from PDM on 12/Dec/2017. Owners cannot arrange this inspection and obtain this cert when she was in Indian ocean.

The charterers are not entitled to require the vessel return to load port just only to conduct this inspection and obtain the cert, which is not commercial sense. As Lord Denning said in Barrett Bros. (Taxis) Ltd. v. Davies case, The law never compels a person to do that which is useless and unnecessary.

The charterers may contend that this cert is necessary, but it's unnecessary at load port, So H case is not seaworthiness case.

It's common ground that the vessel should be carried out quarantine inspection in most Chinese ports,Mosquito eradication control certificate is just part of the quarantine and customs procedures. The cost for this arrangement should be treated as port charges.

In respect of portcharges, 《Time Charter》-Chapter 12,12.14 which provided:

12.14 Port charges include all charges which a ship has to pay before she leaves a port, even if some of those charges relate to benefits which will accrue to the ship only after she has left the port.

The charterers of the Apex were obliged by a special clause to pay the port charges at Deptford if they ordered the ship to discharge deck cargo there, which they did. The port charges payable at Deptford included Trinity House dues in respect of lights to be passed during the remainder of the voyage to Leith where the under deck cargo was to be discharged. Had the ship gone straight to Leith without calling at Deptford these dues would have been payable by the owners. Mathew,J., held that the charterers were responsible for these dues. He said: “The ordinary meaning of the phrase seems to me to be those charges which a vessel must pay before she leaves a port.” Newman & Dale v. Lamport & Holt[1896] 1 Q.B. 20.

It's clear that the costfor this inspection should be paid before the vessel leave the port, hence that this cost should be deemed as port charge. Charterers require Owners to pay which is unjust. Charterers should instruct their agent to add this cost to final port d/a. However, pursuant to our COA, The max port d/a for one port isusd 90,000. Thus, Owners will pay max usd 90,000 only.

Hope above is clear andwill be acceptable by charterers.

Needless to say that ifany delay which will be for charterers their sole account.

该电邮大意是,指出租家声称的The “Madeleine”案,缺少必要的证书导致船舶不适航和H轮的区别。在The “Madeleine”案中,是以巴尔的摩格式,3个月的期租合同;但由于船舶没有除鼠证书,港口当局不让开航,导致船舶不能在销约期内交船。Roskill法官认为合同条款规定了船舶在各个方面适航装载货物,默示了船舶的适航性。但H轮的情况并不一致,在巴西装港并没有这方面的要求;而且中国质检总局发出的黄热病公告在2018年1月19日,而H轮在2017年12月12日已经离开装港;在有此要求前已经在印度洋。同时指出,法律从不会强迫一个人去做无用和不必要的事,租家无权要求船舶开回装港去做检验并获得所谓的证书。

指出灭蚊控制证书只是检疫和海关手续的一部分,和船舶的适航性无关,认为此费用应该归于港口使费。引援权威参考书《Time Charter》第12章,12.14关于港口费用的表述:

港口费用包括船舶在离开港口之前必须支付的所有费用,即使这些费用中的一部分与船舶离开港口后所产生的利益有关。

同时引用Mathew法官在Newman &Dale v. Lamport & Holt案中关于港口费用的如下陈词:

这句话的通常含义在我看来是船舶在离开港口之前必须支付的那些费用。

指出船东将按合同来支付包干的港口使费,如果有任何延误将由租家自己承担。

当然,如果合同规定不同,比如港口使费和运价没有挂钩,也不是包干的,不管多少均由船东自己承担,那么争辩此费用是否可归属港口费用就没有多大意义。

当然,如果合同规定不同,比如港口使费和运价没有挂钩,也不是包干的,不管多少均由船东自己承担,那么争辩此费用是否可归属港口费用就没有多大意义。

但是如果所收取的费用不是港口当局收取的,那么情况将不一样。之前曾碰到,关于巴西某些港口,收取的Infra Structure Utilization Tax(基础设施使用费),这个费用是否算是港口费用?

有COA合同,规定装港的港口使费用由船东承担。针对这个基础设施使用费,船东认为由最下家发货人自己收取,因此不能转嫁到船东身上,拒绝承认此费用为港口使费。租家单纯不同意,于是船东发了封电邮来解释,其中部分中英文对照的如下。

Thanks for charterers’ last, Owners fully support Charterers’ last example, the customer no need to pay additional money to the taxi for fair wear and tear.

多谢租家回复,船东完全支持租家举得例子,顾客不需要支付额外的的士正常损耗的费用给司机。

But as charterers aware the true situation is that the charterers require Owners to pay money in advance for their maintenance purpose, such as navigation channel,light buoys, channel drafts navigability, mooring/unmooring equipments,fenders, berthing piers and etc. If the charterers not require this, Owners also will not require the Charterers to pay money for Owners to maintain their vessel.

但想必租家清楚真实的情况是这样的,租家要求船东支付他们保持航道,灯浮,航道水深,系缆/解缆设备,碰垫,泊位处于良好状态等的费用在先。如果租家不要求船东支付这个,那么船东也不会要求租家支付这个费用来维修保养他们的船舶。

Anyhow,In spirit of Good cooperation, Owners hereby to clarify and explain

again why the Charterers could not shift this Infra-structure utilization tax on to the Owners.

总之,为了良好的合作关系,船东再次澄清及解释为什么租家不可以把这个费用转嫁到船东身上。

1. If the charterers/shipper may contend that this cost should be beared by the buyer in accordance with their sale contract.

It's clear that Owners is not the buyer, the true buyer should be for such as Charterers yourselves, iron ore/steel trader or steelmill. Therefore this cost should be for Charterers' their sole account.

如果租家或发货人可能声称按照他们的买卖合同,这个费用是买家承担的。

但显然船东不是买家,真正的买家是像租家你们自己,铁矿/钢铁贸易商或钢厂。因此这个费用应该是租家自己独自承担。

2. If the Charterers may contend that maintain their navigation channel, light buoys, channel drafts navigability,mooring/unmooring equipments, fenders, berthing piers and etc in good order enable to provide the better service for the Owners, therefore this cost should be for Owners' account.

Fyi,Owners also wish to maintain their vessel' engine/boilier / generator /bridge equipments etc in good order enable could provide the better service for the Charterers. the cost is the same name asInfra-structure utilization tax, usd40,000 per voyage at discharge port.

As per Charterers' logistic, this cost should be for Charterers' account.

如果租家可能声称保持航道,灯浮,航道水深,系缆/解缆设备,碰垫,泊位处于良好状态等是为了给船东提供更好的服务,因此应该船东来承担。

据您所知,船东也希望保养好他们的船舶主机/锅炉/发电机/驾驶台设备等等处于良好的工作状态以便给租家提供更好的服务,这个费用名也叫Infra-structure utilization tax,在卸港4万美金每个航次。

那么按照租家的逻辑,这个费用应该由租家来承担。

3. Obviously that, both arguments as above are not reasonable and acceptable.

For avoidany breach charterers their safety warranty, the Charterers have to

maintain theirnavigation channel, light buoys, channel drafts navigability,mooring/unmooring equipments, fenders, berthing piers and etc in good order and condition, which are the Charterers their responsibilities and obligations

The same, Owners also have to maintain their vesselall engine and deck equipments in good order and condition, Inother word,keep vessel seaworthiness and cargoworthiness, these are owners' responsibilities and obligations.

Trust the Charterers will not pay any money for owners to purchase spares, so whythe Charterers still require the Owners to pay the money for their buoy or fenders?

很显然,前面的狡辩都是不合理和无法接受的。

为了避免违反安全保证,租家应该保持航道,灯浮,航道水深,系缆/解缆设备,碰垫,泊位处于良好状态等,这是租家他们自己的责任和义务。

同理,船东也应该保持他们船舶机舱及驾驶台设备处于良好的工作状况,换句话说,使船舶适航适货,这些是船东的责任和义务。

相信租家不会给钱给船东去购买船舶备件,那么为什么租家仍然要求船东付钱给租家为了他们的灯浮或碰垫呢?

4.Refer to Charterers’ taxi example, Owners also wish to take one instance. Trust the charterers well aware the airport constructionfee, which are for passengers’ account, not the airplane.

The same, this Infra-structure utilization tax should be on cargo, not on the vessel. Now, in accordance withclause 14 of this COA, for tax on cargo which are for charterers’ sole account.

参租家据的出租车例子,船东也想举个例子。相信租家对机场建设费异常清楚,这个是乘客的费用,而不是飞机。

同理,这个Infra-structure utilization tax也应该是货物的。那么,按照合同第14条,属于货物的费用应该是租家自己的费用。

租家转而声称此费用是一种税,对船舶征收的,因此按COA合同条款应该由船东来承担。

于是又发了封解释电邮,其中部分内容如下。

Further to Owners’ last message which was sent to Charterers on 11th/Jan o/a1442hrs, Owners hereby reemphasize that Infra-structure utilization tax could not be considered at port charges and this “tax” is also not one kind of tax,not Charterers alleged on vessel/freight.

参船东11日约1142的邮件,船东再次重新强调,这个Infra-structure utilization tax不能算为港口使费,这个Tax也不是常说的税,更不是租家所说的是关于船舶或运费的税。

In respect of Infra-structure utilization tax, Owners have double check with charterers’ agent and get below which is self-explanatory:

关于这个Infra-structureutilization tax,船东已经重新找租家代理查核,并收到如下清晰的解释说明:

It is related to keep in condition the navigation channel, light buoys, channel drafts navigability, mooring/unmooring equipments, fenders, berthing piers and etc.

这个费用是为了保持航道,灯浮,航道水深,系缆/解缆设备,碰垫,泊位处于良好状态等等。

It’s no doubt that the charterers collect this money just only for maintain their facility in good order/condition to avoid any breach their safety warrantyand/or their business purpose, such as could export more cargo with more sailing draft.

显而易见租家收取这个费用仅仅是为了维修保养他们的设施处于良好状况避免他们违反安全保证或者为了他们自己的生意,有更大的离港吃水以便多出货。

In respect of this safety warranty, Charterers please refer to below items which may cause port unsafe. If charterers have any doubt for this, Charterers please feel freeto double check with LSLC ( London Shipping Law Centre).

关于这个安全保证,租家请查看以下这些能造成港口不安全的因素,如果租家对此有怀疑,可以去找LSLC伦敦航运法中心查核。

l Grounding risks – on banks, bars, rocks andsubmerged objects

l Berthcharacteristics – fendering, air draft, water draft, obstructions andconfiguration

l Portset-up – berthing procedures, tugs, pilotage arrangements andpersonnel

If the channel is not with sufficient draft, missing light buoys or fenders,mooring/unmooring equipments/piers are not in good order which will cause the charterers breach their safety warranty.

如果航道没有足够水深,没有灯浮或碰垫,系缆/解缆设备/泊位没有处于良好状态,那么将造成租家违反安全保证。

And now Charterers are called upon to review rather carefully below the definition ofthe standard disbursement account form BIMCO:

那么现在,租家请再次仔细查核关于来自BIMCO关于标准港口使费的定义,如下:

Harbour Dues 锚地费

Light Dues 灯塔费

Pilotage 引水费

Towage 拖轮费

Mooring/unmooring系缆/解缆费

Shifting 移泊费

Customs charges 海关费

Launch/car hire 小艇/小车费

Agency remuneration 代理费

Telex,postage,telegrams 电传费,邮寄费,电报费

And clause14 of this COA which clear stipulated only below items could be considered as port charges:

另参COA合同第14条关于港口使费已经清晰列明的部分如下:

1. Tonnage dues

船舶吨税

2. Harbour dues, berthing charges,pilotage, shifting, towage charges, mooring, unmooring charges, charges for opening/closing of hatches, light dues.

锚地费,泊位费,引水费,移泊费,拖轮费,系缆费,解缆费,开/关舱费,灯塔税

3. Agent fee and other miscellaneous service charges.

代理费及其杂费(杂费引BIMCO解释包括电传费,邮寄费,电报费)

It’s clear that not including Infra-structure utilization tax which was collected by the charterers, and just for to keep in condition the navigation channel, lightbuoys, channel drafts navigability, mooring/unmooring equipments, fenders,berthing piers and etc.

很清楚港口使费不包括租家收取的这个Infra-structure utilization tax费用,仅仅是为了保持航道,灯浮,航道水深,系缆/解缆设备,碰垫,泊位处于良好状态等等。

If the charterers still no willing to accept above, Owners may have no choice but toadd usd 40,000 each voyage as port charges at discharge port(agent should remitto Owners directly) ,for maintain their vessel’s main engine/boiler etc in goodorder/condition and repaint vessel’s hull enable the vessel look nice &shinny. Trust Charterers may also find this item is unreasonable, could not be considered as port charges.

如果租家仍然不愿意接受以上解释,那么船东将别无选择,每航次将添加4万美金为卸港港口使费(代理需直接付给船东),用来主机/锅炉等等维修保养以便处于良好的工况,及重新喷船壳以便船看起来更漂亮些。相信租家也会认为这费用是不合理的,不能当作是港口使费。

关于这个Infra Structure Utilization Tax(基础设施使用费),租家一直胡搅蛮缠,一会说Taxes on vessel/freight, 一会说是agent fee and other miscellaneous service charges中的other miscellaneous service charges。在1月26日收到租家的如下回复,说是按government tax来收的。

Charterers disagree with Owners, because The Infra Structure Utilization Tax is a component of port expenses (to provide facilities, access channel etc) .

As Owners are aware the Terminal XX. acts as Port Operator and Operator who is responsible for collecting Infra Structure Utilization Tax.

This suchInfra Structure Utilization Tax is applied the government Tax.

Considering this Charterers cannot understand the reason that Owners is rejecting to pay the tax.

XX租家的此辩解是否站得住脚呢?情况显然不是这样。针对租家这个问题作了如下答复:

Duly noted charterers’ last comments, but regret that Owners are unable to accept Charterers’ last allegation.

As Owners note that the infrastructure of ports and terminals in Brazil needs to be updated to suit modern sizes of vessels and trade demands, Brazil’s new Port Law (Law No. 12.815/13-Nova Lei De Portos) ,( refer to“ New law” ) was enacted and became effective on June 5, 2013, bringing significant changes to Brazil’s port regulatory regime and aiming to increaseprivate investment in Brazilian ports, essential to tackling one of thecountry’s most prominent logistical bottlenecks.

It aims, amongst other things:

-to increase private and government investment

-to upgrate the current port and terminalfacilities

-to redeuce bureaucacy, cost and taxes

-to increase competitiveness of Brazilian trade;and

-to provide a significant update to the ports’and terminals’ regulatory/legal framework

Charterers contended that the Infra Structure Utilization Tax (refer to “ this tax”) is applied the government Tax which is groundless.

Pursuant to Section II of New law, Art 24-IV, It is the responsibility of the customs department of the Ministry of Finance to collecttaxes if any:

IV-Collect taxes due with regard to international trade VIII-Administrate the application of taxsuspensionis, exonerations or returns with regard to both imported and exported merchandise

For taxes due such as Free pratique tax and Immigration tax whichwill be collected by the customs department of the Ministry of Finance.

Owners wish to point out that there is no any Infra StructureUtilization Tax for other vessels calling Brazilin ports, i.e The customsdepartment of the Ministry of Finance never collected this kind of tax.

If the charterers wish to collect this illegal tax, Owners wish todraw the charterers their keen attention to Art 62 of New law which provided:

Art.62. Noncompliance by concessionaires, leaseholders, authorized operators and port operators, in terms of the collection of port taxes and other financial obligations due to the port administration andto Antaq, will result in their inability, after the appeal process has been exhausted, to sign or extend concession or leasing contracts nor obtain new authorizations.

For this authorization, refer to Section II Art.8.2:

The Authorization will be for up to 25(twenty-five) years, and maybe extended for subsequent periods, on the following conditions:

I-port operations are maintanined; and II-The contracted party makes the necessaryinvestments for the expansion and modernization of port facilities as liad outin the regulations.

Such maintenance & necessaryinvestments not limited to Chapter VIII, Art 53.

Art. 53. The II National Dredging Program for Ports and Waterways is hereby instituted and will be implemented by the Secretariat for Ports of the Presidency of the Republic and by the Ministry ofTransportation each in their respective areas. § 1o This program covers, amongother activities:

I - the dredging works and civil engineering services required to maintain or expand port and waterway areas, including navigation channels, maneuvering and anchorage basins, shipping berths, theremoval of submerged material, the excavation of the sea floor and river bottoms, and the removal of rock formations;

II - the beacon service, including the acquisition,installation, replacement, maintenance and modernization of nautical beaconsand equipment required for waterways and to access ports and port terminals;III - environmental monitoring; and

IV - the management of the works and services.

Which also stipulated in Art 18 of Chapter IV Section I:

Art. 18. Within the limits of the statutory portthe port administrator is responsible for:

I - under the coordination of the maritimeauthority:

a) implement, maintain and operate the beaconing of the port’s access channel and maneuvering basin;

It’s clear that maintenance and necessary investments should be for charterers’ responsibilities& liabilities.

Owners as innocent party, are no bound to bear this tax for charterers their business purpose.

Further, As charterers last advise, Vale as last charterers andalso as port operator, now pursuant to Art 26 of Chapter V:

Art. 26. The port operator will be responsible to:

I - the port administration for any damage will fully caused to the infrastructure, the facilities and equipment owned bythe port administration and which are in use by, or under the responsibility of, the port operator;

II - the owner or consignee of merchandise for any loss or damage which occurs during operations carried out by the operatorin the port, or resulting from them;

III - the shipping company for any damage occurred to its vessel or to the merchandise handed over for shipment;

…

Which are ulmost the same as safety warranty clause, Thecharterers should warrant the berth andport are safe for the vessel.

Hope above are clear enough and the charterers could fully understand.

But if the charterers stillwish to shift their responsibilities/obligations to Owners, ought torecover the cost from Owners despite of which are clear stipulated in New Law.

No matter what have stipulatedin charterers’ their leasing and concession contracts, Owners wish toreemphasize that as per governing the clause 14 of this COA,only below items could be considered as port charges:

1. Tonnage dues

2. Harbour dues, berthing charges,pilotage, shifting, towage charges, mooring, unmooring charges, charges foropening/closing of hatches, light dues.

3. Agent fee and other miscellaneous service charges.

It’s no doubt that portcharges not including this tax.

Thus the charterers are not entitled to require the Owners to pay this tax as port charges.

该电邮的大意内容就是,巴西联邦政府在2013年出台新的Brazil’snew Port Law (Law No. 12.815/13)(以下简称“新法”)以取代之前的Port Law( Law No.6.630/93), 旨在增加私人及政府投资来改善港口设施及迎接2014年足球世界杯。其目的有如下:

-to increase private and government investment

-to upgrate the current port and terminalfacilities

-to reduce bureaucacy, cost and taxes

-to increase competitiveness of Brazilian trade;and

-to provide a significant update to the ports’and terminals’ regulatory/legal framework

出台新法的第一个目的就是为了提高私人及政府投资以改善环境。

参别的报道,巴西政府每年在Infra Structure上投入约2.1% GDP。

按新法第24条,由巴西联邦政府财政部下属的海关来收取这个taxes due.

IV-Collect taxes due with regard tointernational trade

VIII-Administrate the application of taxsuspensions, exonerations or returns with regard to both imported and exportedmerchandise

按新法第62条,承包人如XX无权替代政府部门来收取port taxes and other financial obligation due.

Art.62. Noncompliance by concessionaires, leaseholders, authorized operators and port operators, in terms of the collection of port taxes and other financial obligations due to the port administration and to Antaq, will result in their inability, after the appeal process has been exhausted, to sign or extend concession or leasing contracts nor obtain new authorizations.

按新法第8条,第53条,第18条如下:

Section IIArt.8.2:

The Authorization will be for up to 25(twenty-five) years, and may be extended for subsequent periods, on the following conditions:

I-port operations are maintained; and

II-The contracted party makes the necessary investments for the expansion and modernization of port facilities as liad out in the regulations.

Chapter VIII, Art 53.

Art. 53. The II National Dredging Program for Ports and Waterways is hereby instituted and will be implemented by the Secretariat for Ports of the Presidency of the Republic and by the Ministry of Transportation each in their respective areas. § 1o This program covers, amongother activities:

I - the dredging works and civil engineering services required to maintain or expand port and waterway areas, includingnavigation channels, maneuvering and anchorage basins, shipping berths, theremoval of submerged material, the excavation of the sea floor and riverbottoms, and the removal of rock formations;

II - the beacon service, including theacquisition, installation, replacement, maintenance and modernization ofnautical beacons and equipment required for waterways and to access ports andport terminals; III - environmental monitoring; and

IV - the management of the works and services.

Art 18 of Chapter IV Section I:

Art. 18. Within the limits of the statutory port the port administrator is responsible for:

I - under the coordination of the maritimeauthority:

a) implement, maintain and operate the beaconing of the port’s access channel and maneuvering basin;

这些都列明港口承包者XX必须对港口维修及必要的投资来改善港口环境。

从租家的电邮可以看出,显然租家他们并没有要把该费用当作Tonnage due来对待;而且巴西政府已经强制收取了light due,想必他们也知道不能再算作是tonnage due。在巴西政府自己经营的港口,并没有收取这个Infra Structure Utilization Tax费用,比如Itaguai港。

而且别的船舶,纵然合同中已经明确规定如下:

Infra structure Utilization Tax is for the Owners’ account and A.F.R.M.M ( Brazilian Maritime Renewal Tax ) is for the Charterers’ account.

All canals,locks and any other river or waterway tolls including but not limited to tolls and dues to be the responsibility of and paid for by the Owners.

这个InfraStructure Utilization Tax费用由船东承担,但该合同下的XX租家也未收取此费用。因为如果XX收了这个费用,港口使费增加了,相同TCE下,对应的运价也得增加。

这种Infra Structure Utilization Tax费用(港口设施使用费)XX租家自己收取的费用,并非官方政府收取,而且可收可不收,也不符合Mathew 法官在Newman& Dale v. Lamport& Holt[1896].案中的关于港口费用的权威表述,在船舶离港前必须支付的费用。那么反过来说,这个Infra Structure Utilization Tax很显然不是船舶离港前必须支付的费用, 因此不能被称为港口费用。

关于港口费用,也可参《Black’sLaw Dictionary》中的解释如下:

Port charges, dues, or tolls.

Pecuniary exactions upon vessels availing themselves of the commercial conveniences and privileges of a port.

港口予以商业便利而利用其特权对船舶强行收取的金钱。

与港口费用相关的判例很少,可能是当事人对此方面的规定似乎都没有什么争议。之前文章,The“Isabelle”案中有提到,因恶劣天气等所产生的港口强制的移泊费用船东承担。

在Christianssand Shipping Co. v.Marshall案中,争议涉及到租船合同的非常普通的话题,但反对的论点变得非常有趣。当事人双方采用了货运委员会的合同形式且各方同意的内容。该框架适用于从指定的南美港口到美国任何北大西洋港口的运输。这给了托运人选择卸货港的选择权。由于运费率是固定的,因此所选的港口变得重要。当事人试图达成适当的调整,即指定费率应涵盖将货物运至“港口”的所有费用,除了商定的运费之外,这些款项将由收货人支付。但这里遗留下了港口限制的问题。租船合同在第9条中规定,收货人应支付所有“港口”费用,且将这一短语定义为包括拖航。

合同的指定装运港是阿根廷罗萨里奥。根据第10条,这个港口被特别命名为在达到和离开那个河流拖轮费落在收货人身上。关于这个港口特别提到的可能存在的任何现有理由,除了关于该地点离它所在的河口有一段距离的常见地理知识以外,没有别的内容。然而,在所签订的合同中,罗萨里奥不是装货港,也不是第10条的一部分,因为该条款已全部删除。该轮装运的是树皮,卸货港是费城,也是卸货码头的地方。这艘船是通过拖轮拖出的,然后拖上了特拉华湾和河流并停靠。承认拖轮的服务在达到所有争端之外的“港口”之后才能停靠船舶,并且这些费用由被诉人自愿支付。然而,他区分了他认为是适当的“港口费用”的拖航服务和可能被称为“河流拖航”的类似服务。

最终地区法院的Dickinson法官判,河内的拖轮费属于“港口费”,依据合同第9条规定,应由收货人支付。

关于港口使费,除非合同已经清晰列明归属,要不应依Mathew 法官所说,那些在船舶离港前必须支付的费用为港口费用。当然当事方自己收取的除外,但如果合同列明当事方自己收取的也可算是港口费用,那么情况又将不一样。合同解释,必须将整个条款作为一整体来解读。

最后以Roskill 法官在The“Madeleine”案中第238页如下判决书作为本文的结尾。

It is well established that clauses in charter-parties cannot be construed in isolation from each other. A charter-party like any other contract must be construed sensibly and in its entirety. Where one has a series of clauses in a standard form which has been in use for a great many years, and which has been interpreted many times by the Courts and by arbitrators, the Court must look at the provisions as a whole.

公认的是租船合同中的条款不能孤立地解释。租船合同像像任何其他合同一样必须理智而全面地解释。如果一个人有多年使用的标准形式的一系列条款,而且法院和仲裁员已多次解释这些条款,法院必须将整个条款视为一个整体。

海运圈聚焦专栏作者 Alex (微信公众号 航运佬)

海运圈聚焦专栏作者 Alex (微信公众号 航运佬)

2018-02-22

2018-02-22 2423

2423